Planned Giving

Donor-Advised Fund

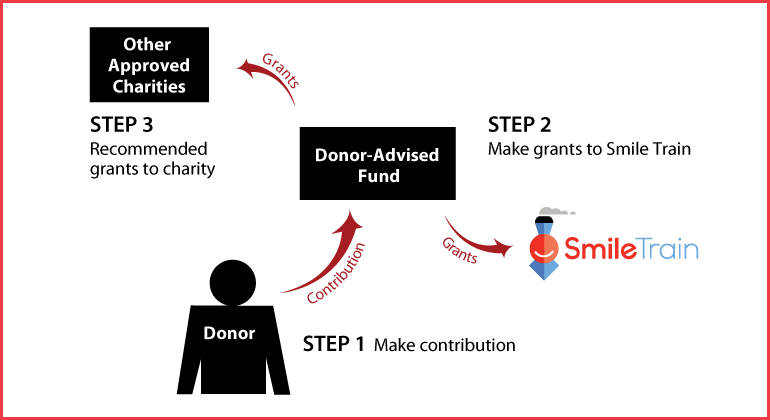

How It Works

- You make a contribution to a donor-advised fund at Smile Train

- You advise Smile Train where you want to make grants

- You may make recommendations for additional grants to approved charities

Benefits

- You create a fund to support Smile Train and other charities

- You receive an income-tax deduction for your original contribution to the fund

- Your fund will receive professional asset management

- You have the flexibility of making grants to charities on a flexible timetable

Contact Us

Julie McIsaac

Director, Planned Giving

212-689-9199

JMcIsaac@smiletrain.org

Smile Train

633 Third Ave, 9th Floor

New York, NY 10017

Federal Tax ID Number: 13-3661416

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer