Planned Giving

Real Estate—Outright Gift

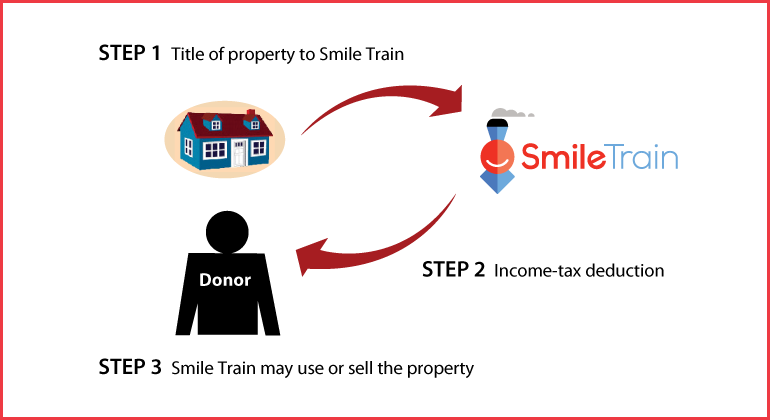

How It Works

- Transfer title of property to Smile Train

- Receive income-tax deduction for fair-market value of property

- Smile Train may use or sell the property

Benefits

- Income-tax deduction for fair-market value of property based on qualified appraisal

- Avoid capital-gain tax on appreciation in value of the real estate

- Relieved of details of selling property

- Significant gift to Smile Train

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Nick McGann |

Smile Train Federal Tax ID Number: 13-3661416 |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer